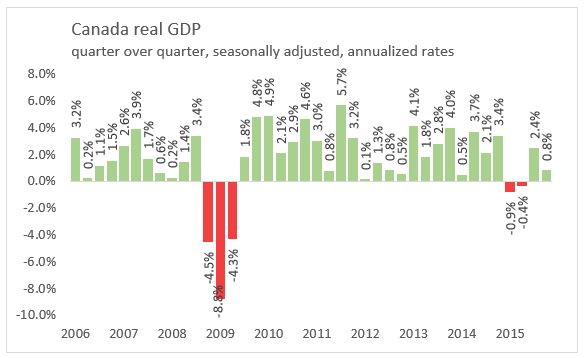

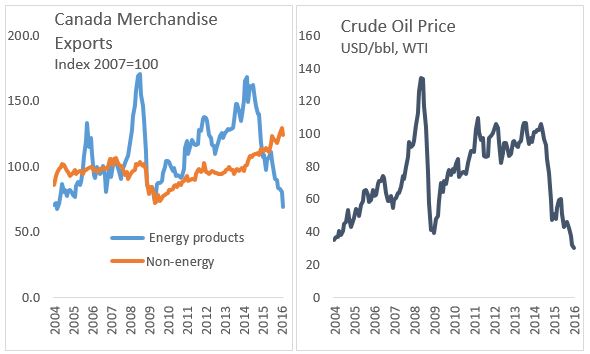

April 21, 2016CURRENT ECONOMIC ENVIRONMENT AND OUTLOOK - CANADA Canada’s recovery and expansion from the 2009 recession depended heavily on investment in and exports from natural resources. This ended with the recent collapse in commodity prices, especially oil. Prior to the collapse, Canada’s recovery was disproportionately concentrated in provinces richly endowed with natural resources: Alberta, Saskatchewan and Newfoundland and Labrador.

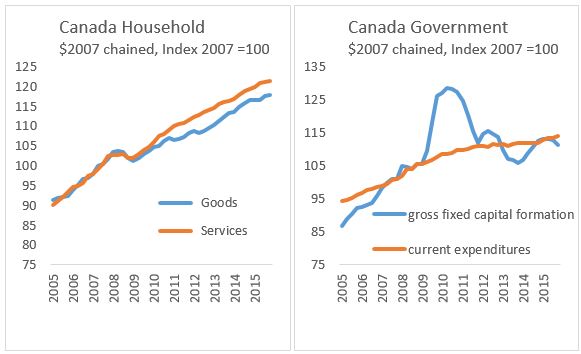

Falling energy prices pulled Canada into a technical recession during the first half of 2015, though the downturn was concentrated in the oil-producing regions. By the third quarter, Canada was again reporting solid economic growth coming from consumer spending and recovering exports. In the fourth quarter, a retreat in consumer spending and exports slowed growth again. In 2015, Government spending slowed as both federal and provincial governments repaired deficits after previous years of stimulus investments.

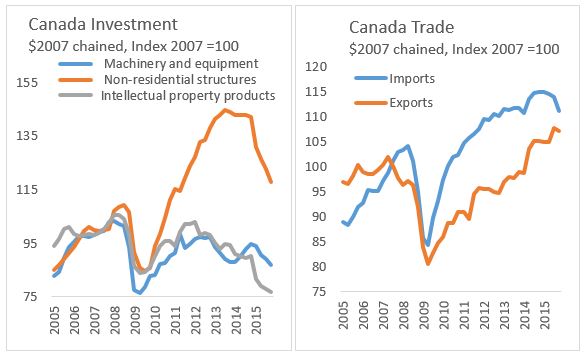

With the completion or suspension of oil projects, that once dominated Canada’s non-residential investment, capital spending has been a drag on Canadian economic growth in 2015. Oil prices are not expected to recover as quickly in 2016 as initially anticipated and further reduction in capital plans may occur. Residential investment continued to contribute to growth, expanding 3.9 per cent in 2015.

The lower Canadian dollar and stronger US economy have lifted non-energy exports over the past two years. The volume of imports have also fallen with the lower Canadian dollar. Energy exports have moved lower with the selling price. The trade balance widened in 2015 compared to previous few years and stood at $1.9 billion in February 2016.

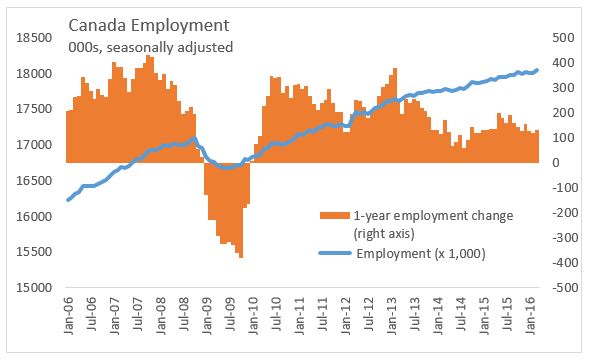

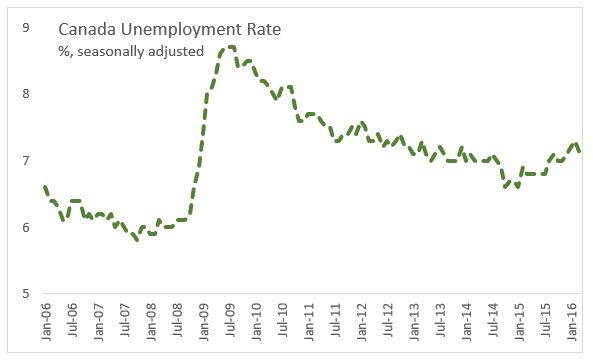

Employment growth has slowed in Canada. From 2010 to 2013 employment grew at around 1.4 per cent per year. As oil prices fell in 2014 and 2015 employment growth slowed to 0.6 and 0.8 per cent respectively. The economy continued to add around 25,000 jobs per month over the past year, but this has been at a slower pace than the growing labour force, pushing the unemployment rate above 7 per cent.

Deteriorating labour market conditions were particularly noticeable in oil-producing regions of the country. Since 2013, monthly unemployment rates have risen by over 3 per cent in Alberta and by over 2 per cent in Saskatchewan and Newfoundland and Labrador. Over the same period, unemployment rates have fallen in Ontario and, to a lesser extent, in other non-energy producing provinces.

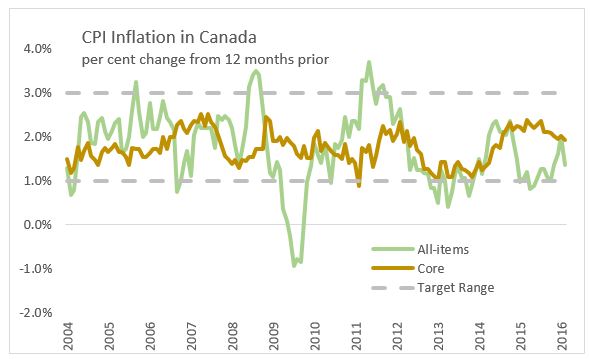

In response to the oil price shock, the Bank of Canada reduced its overnight target rate by 0.25 percentage points in January 2015 as a preventative measure to a likely downturn in the economy. A further cut of 0.25 percentage, in the overnight target rate, was made in July to set it at its current 0.5 percent. Interest rates for businesses and consumers were low by historical standards, even prior to these most recent policy changes. The latest Bank of Canada decision was to maintain the overnight target rate. Interest rates remain accommodative today and should facilitate a shift in capital and labour from the resource sector into other sectors of the economy. The Bank of Canada is expects output gap will close mid-2017. The lower Canadian dollar has pushed up retail food costs in Canada. The Consumer Price Index increased 1.1 per cent in 2015, with a 9.6 per cent decrease in energy costs offset by increases in food prices. The consumer price index excluding food and energy was up 1.8 per cent in 2015 and Core inflation was slightly above 2 per cent in 2015.

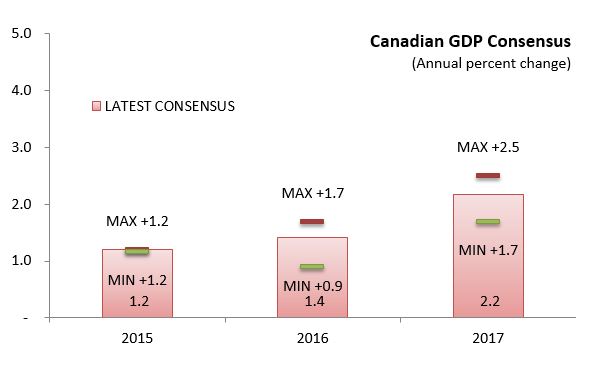

The private sector consensus has Canada growing continuing with soft growth in 2016, at 1.4 per cent before picking up to 2.2 per cent in 2017. Improving non-energy exports and fiscal stimulus measures are expected to support the economy while it transitions.

Note: The Nova Scotia Department of Finance monitors private sector forecasts from major financial institutions as well as the Conference Board of Canada, IMF, World Bank, central banks and OECD to prepare a consensus outlook for the world, the US, Canada. The latest consensus was prepared March 22, 2016.