The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

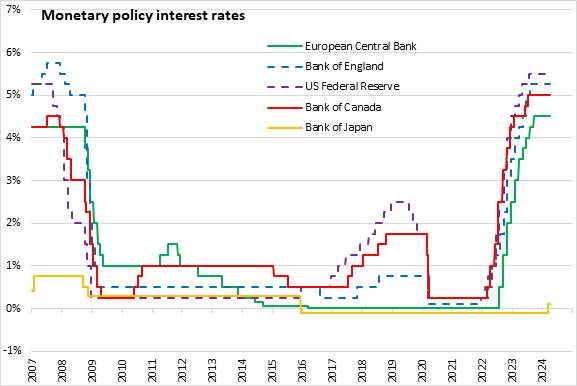

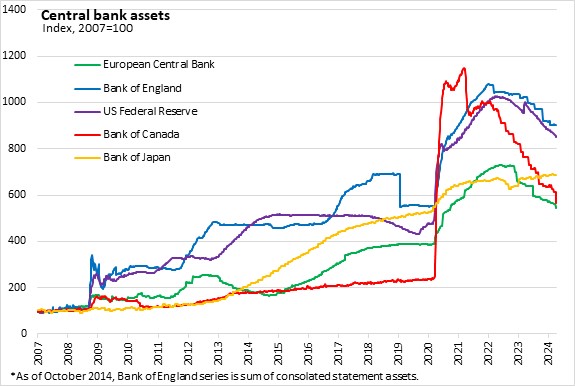

April 10, 2024BANK OF CANADA MONETARY POLICY The Bank of Canada maintained its target for the overnight rate at 5%, with the Bank rate at 5.25% and the deposit rate at 5%. The Bank is continuing its policy of quantitative tightening.

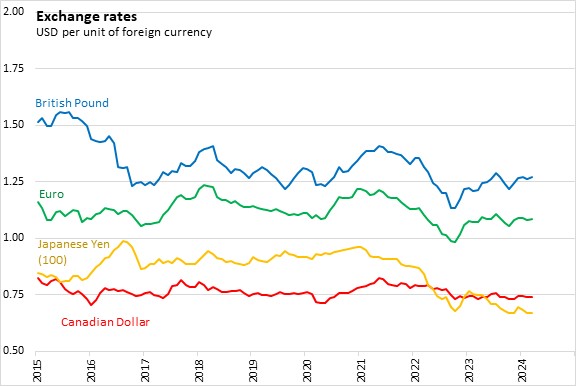

Global economy is projected to grow around 3% over the projected horizon (2025-2026). US economic growth has recently slowed, but proved to be stronger than anticipated and is expected to average 2.5% in the first half of 2024. The growth is supported by increased consumption after strong gains in real income, business investment boosted by stronger consumer demand, and robust government spending. Euro area economic growth remains weak, but is anticipated to pick up in the second half of 2024. Inflation has continued to ease in both jurisdictions.

Canadian economic growth was stronger than expected in the fourth quarter after contracting in the third. Economic growth is on track to rise to roughly 2% in the first half of 2024. Consumer spending is anticipated to average 1.5% over the first half of 2024, driven by strong population growth. Residential investment is expected to strengthen in the first half of 2024, due to strong demand from population growth and a tight supply. Government spending is projected to pick up to 3.5% in the first half of 2024. Growth in exports is expected to be volatile in the first half of the year, impacted by weather disruptions and the timing of gold shipments. The start of Trans Mountain Expansion project is expected to add approximately 0.25 percentage points to GDP growth in the second quarter. Business investment is expected to pick up modestly after a period of contraction.

Labour market conditions are continuing to ease with job creations slower than the increase in the working-age population. Unemployment rose to 6.1% in March and the job vacancy rate has declined to near pre-pandemic levels. Wage growth is slowly beginning to ease in Canada. The Bank of Canada notes that the data is indicating that the Canadian economy is in excess supply.

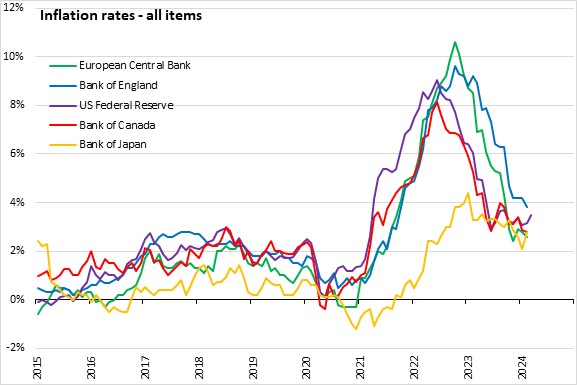

Inflation eased to 2.9% in January and 2.8% in February due to further moderation of prices for goods and a fall in energy prices. Shelter services price inflation remains high at 7%, driven by increasing mortgage interest costs and strong growth in rent.

After stalling in second half of 2023, Canadian GDP is estimated to rebound in early 2024. Through the end of 2024 and early 2025, the Bank notes that growth projections are underpinned by growth in GDP per capita. Growth in GDP per capita is expected to be driven by easing financial conditions and rising confidence. On an annual average, GDP is expected to be around 1.5% in 2024, 2.2% in 2025, and 1.9% in 2026. Strong migration is expected to offset the ongoing weakness in productivity growth. Moderate excess supply in the Canadian economy is likely to remain through 2024. This is expected to help inflation return to target. In second half of 2024, inflation is expected to fall below 2.5%, before reaching 2% in 2025. The economy is forecasted to return to balance in 2026.

Risks to the outlook for inflation remain, particularly the persistence of underlying inflation. The Governing Council will wait to see further and sustained easing in core inflation before considering lowering the policy interest rate. The Bank also continues to monitor the balance between demand and supply, inflation expectations, wage growth, and corporate pricing behaviour.

The next scheduled date for announcing the overnight rate target is June 5, 2024. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection on July 24, 2024.

Bank of Canada: Rate Announcement; Monetary Policy Outlook

<--- Return to Archive