The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

April 03, 2024MANITOBA BUDGET 2024-25 The Province of Manitoba has tabled its provincial budget for 2024-25, the last provincial budget for this fiscal year.

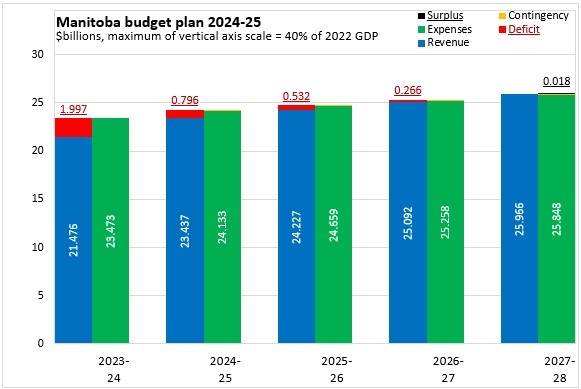

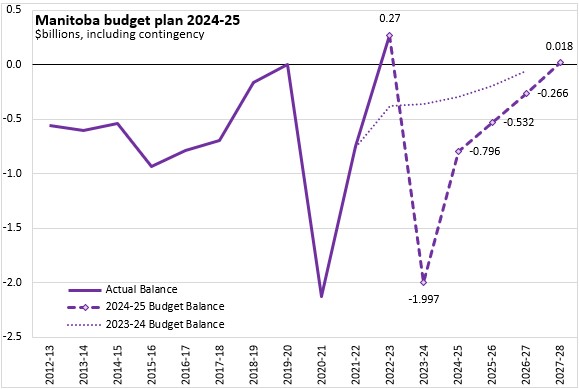

Manitoba's Budget anticipates a deficit of $796 million in 2024-25, down from the most recent forecast of $1,997 million for 2023-24. Manitoba projects deficits of $532 million in 2025-26 and $266 million in 2026-27 before returning to a surplus of $18 million in 2027-28.

After contracting by 3.0% in 2023-24, Manitoba projects revenue growth of 9.1% in 2024-25. In the next three fiscal years, Manitoba's revenue growth is projected to range from 3.4-3.6% per year. Manitoba's expenditures are projected to grow by 2.8% in 2024-25, followed by growth of 2.2-2.4% in each of the next three fiscal years.

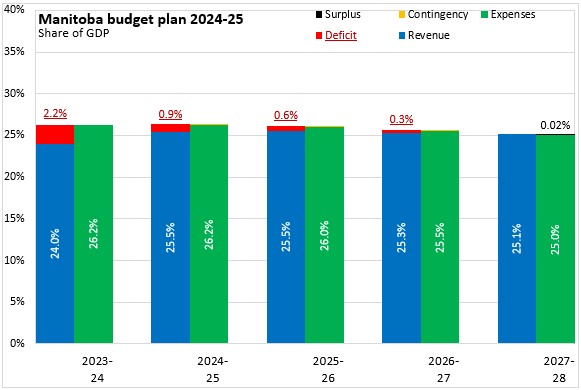

Measured as a share of GDP, the footprint of provincial government in the Manitoba economy amounts to 26.3% of GDP in 2024-25 (26.2% for expenditures and 0.1% for contingency). This is projected to contract to 25.1% of GDP by 2027-28. Manitoba's deficit for 2024-25 amounts to 0.9% of GDP.

Manitoba's net debt to GDP ratio is projected to be 38.5% for 2024-25. The net debt is projected to peak at 39.1% of GDP in 2025-26 before falling back to 38.3% of GDP by 2027-28.

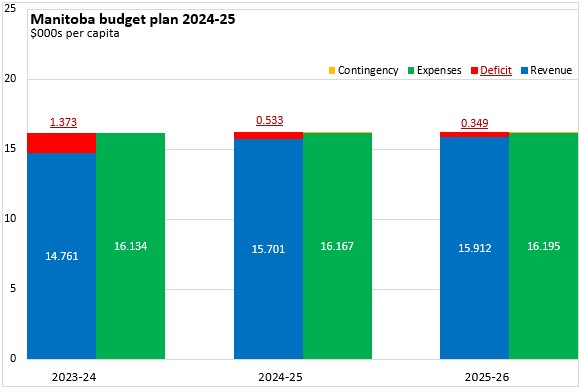

Manitoba's 2024-25 Budget expenditures amount to $16,167 per capita (with a further $67 per capita contingency provision), funded by revenues of $15,701 per capita and a deficit of $533 per capita.

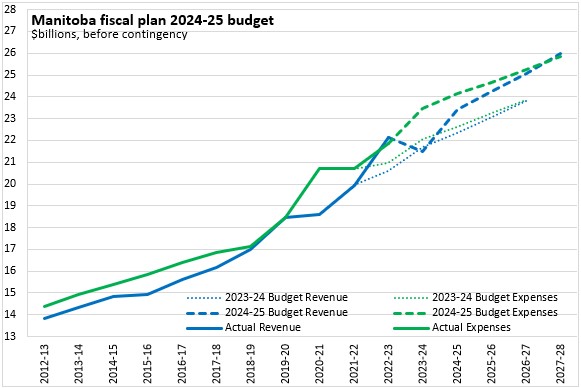

Manitoba's revenues substantially outperformed expectations in 2022-23 while for 2023-24 they are forecast to fall to $238 million below levels projected in the 2023-24 Budget. For 2024-25 and subsequent fiscal years, Manitoba's revenues are now projected to be $1.1-$1.3 billion higher than previously planned in the 2023-24 Budget. Manitoba's expenditures for 2023-24 were $1.4 billion higher than planned in the 2023-24 Budget. For 2024-25 and subsequent fiscal years, Manitoba's expenditures are $1.4-$1.5 billion higher than anticipated in the 2023-24 Budget.

Manitoba's strong revenue growth for 2022-23 contributed to an unplanned surplus of $270 million. However, the deficit for 2023-24 is now forecast to be substantially larger ($1.6 billion variance) than estimated in the 2023-24 Budget. Manitoba's deficits for 2024-25 and the two subsequent fiscal years are wider than planned in the 2023-24 Budget.

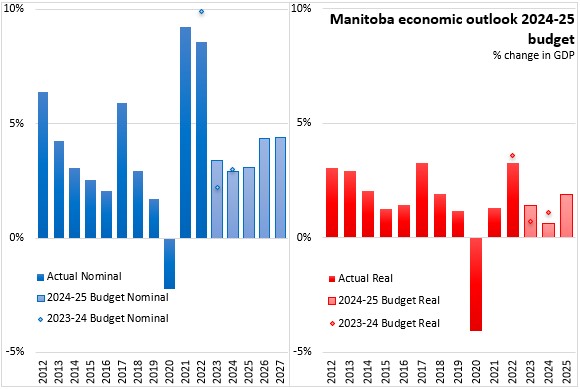

Manitoba's real GDP growth for 2023 is estimated to have slowed to 1.6% as tight monetary policy, supply chain disruptions and geopolitical tensions created headwinds for the provincial economy. Nominal GDP growth was lifted by price and wage growth. For 2024, real GDP growth is projected to decelerate again, slowing to 0.6%, though labour markets are expected to remain resilient. By 2025, Manitoba's economy is expected to be fully into recovery, with real GDP growth of 1.9%.

Key Measures and Initiatives

Manitoba's 2024-25 Budget reflects the new government's priorities for: rebuilding health care, lowering costs, making safer communities, growing the economy and improving government services. Key measures include:

Rebuilding health care

- Hiring 100 doctors, 210 nurses, 90 paramedics and 600 health care aids

- $309.5 million to recruit, retain and train more health care workers, including: $66.7 million to increase bed capacity and reduce ER wait times, $25.2 million to increase critical care capacity (ICUs) and $47.28 million to connect more patients with a family doctor

- $635 million in 2024 for health capital investments

- $17.6 million to open new Minor Injury and Illness Clinics and primary care clinics

- $6.9 million for cancer care

- $22.3 million seniors' care

Lowering costs

- Extending the gas tax cut

- New $1,500 Homeowners Affordability Tax Credit

- Increased $575 Renters Tax Credit

- Up to $328 seniors top-up

- Doubling the maximum Fertility Treatment Tax Credit

- Free prescription birth control

- $10/day childcare all year round

- Five per cent lower auto insurance rates

- $300 security system rebate for families and small businesses

- Indexing the personal income tax bracket thresholds and the basic personal amount

- $4,000 rebate for new electric vehicles and plug-in hybrids; $2,500 rebate for used EVs and plug-in hybrids

- Increased financial support for low-income renters

- Increasing EIA supports for low-income families

- Increased financial aid for post-secondary students

Making communities healthier and safer

- $30 million for a universal school nutrition program

- $116 million in funding to build and maintain social and affordable housing

- Doubling the pre-natal benefit to $162.82

- $3.9 million to establish a supervised consumption site, addiction treatment beds, and support harm reduction services

Growing the economy

- $32.9 million increase for the Federal/Provincial Investing in Canada Infrastructure Program

- $10 million investments in New Flyer Inc. to build more electric buses

- $20.9 million to support new child-care spaces and increase wages for childcare workers

Manitoba Budget 2024-25

<--- Return to Archive